Nduom can challenge GN Bank License revocation at High Court- Supreme Court

This settles the contention as to whether the businessman was legally bound to go for arbitration per the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930) or fight the action at the High Court

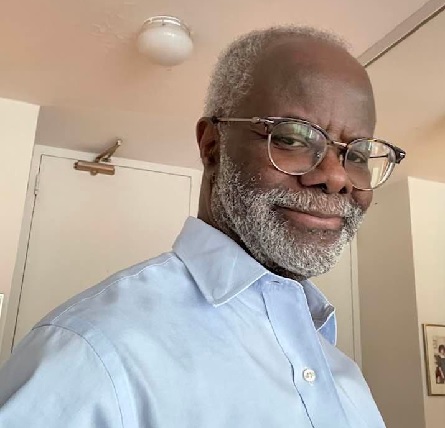

The Supreme Court has cleared, business and politician Dr Papa Kwesi Nduom who is the founder of the defunct GN Bank to challenge the revocation of the bank's licence at the High Court in a human rights action.

This settles the contention about whether the businessman was legally bound to go for arbitration per the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930) or fight the action at the High Court.

Following the revocation of the license of the GN savings and Loans by the Bank of Ghana through the financial sector clean-up, Dr Papa Kwesi Nduom and two others filed a suit at the High Court in 2019.

Subsequently, the Bank of Ghana filed a motion on notice to strike out or set aside the motion on the ground that the substantive action commenced by Nduom and Co was amenable to arbitration pursuant to Section 141 (1) (a) of the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930).

The Central Bank argued that since the action commenced by Nduom and others pertained to the revocation of the licences of GN Savings and loans under Act 930, the proper forum for the ventilation of their grievances should be the one spelt out by the same law thus arbitration.

However, on their part, Group Nduom contended that theirs was purely a human rights action brought under Article 33 of the Constitution and thus same was not amenable to arbitration.

Therefore the High Court, presided over by Justice Gifty Agyei Addo concurred with the respondents noting that they had properly invoked the court’s jurisdiction and thus overruled the objection.

Following this ruling, the Bank of Ghana went to the Court of Appeal to get a ruling that stayed proceedings at the High Court and ordered the parties to go for arbitration per the Banks and Specialised Deposit-Taking Institutions Act, 2016 (Act 930).

Therefore being dissatisfied, Dr Nduom and others filed an appeal at the apex court leading to this verdict being given in his favour.

The Supreme Court, in addition to giving Dr Nduom and others the green light to challenge the revocation as a human rights action at the High Court, noted that compulsory arbitration is not the only avenue for grievance resolution.