Bar Conference’21: Make the fulfillment of tax obligation criteria for lawyers’ good standing-AG to GBA

“Sad to say, many lawyers are caught in the phenomenon of tax evasion as they unjustifiably avoid being caught in the tax net either by understanding their profits or concealing their true income,

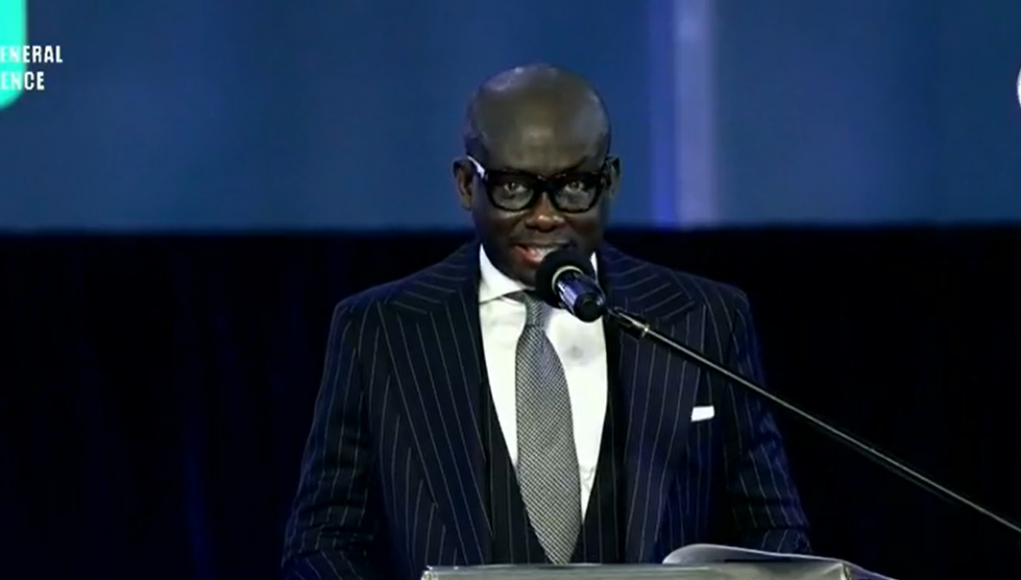

The Attorney General, Godfred Yeboah Dame has suggested to the Bar to make the evidence of the fulfillment of tax obligation by lawyers, criteria for their good standing.

He noted that the luxurious lifestyles of lawyers in riding in plush vehicles and acquiring properties do not match the amount of tax they pay.

“The luxurious lifestyles of lawyers riding in the plushest of vehicles and acquiring top-end properties are hardly commensurate with the amount of taxes they pay,” he said.

“I will suggest that the Bar should as part of the criteria for publication of lawyers in good standing every year, require evidence of the fulfillment of tax obligations,” he added.

Mr. Yeboah Dame made this statement on Monday, September 2021, when he addressed lawyers at the 2021 Annual Bar Conference of the Ghana Bar Association, which is currently ongoing at Bolgatanga in the Upper East Region.

This year’s Bar Conference is on the theme; ENSURING AN INCREASE IN REVENUE MOBILIZATION THROUGH TAXATION FOR THE PURPOSE OF ACCELERATED NATIONAL DEVELOPMENT: THE ROLE OF THE LAWYER.

Further to the above, Mr. Dame noted that the professional and ethical training of lawyers places them in the position to play a fundamental role in the proper functioning of the Ghanaian tax system.

He, as a result, entreated lawyers to have sufficient knowledge of the Tax laws and statutory Regulations. Also, they must be abreast with the various amendments to the various laws to advise clients effectively.

Moreover, The AG bemoaned the fact that many lawyers are caught in the act of tax evasion through their unjustified acts of trying to avoid being captured in the tax net by not disclosing their real income.

“Sad to say, many lawyers are caught in the phenomenon of tax evasion as they unjustifiably avoid being caught in the tax net either by understanding their profits or concealing their true income,” he noted.

Mr. Dame also reminded lawyers of the fact that their failure to honor their tax obligation is not only criminal but borders also on a gross violation of the Legal Professional Conduct and Etiquette. Therefore he called on lawyers to do the needful by honoring their fullest tax obligation.

In conclusion, the Attorney General took a swipe at the Ghana Revenue Authority(GRA) for the lack of effective systems to ensure that all potential Taxpayers are covered in the Tax net.

“I must admit that the failure of lawyers in Ghana to discharge their full tax obligations is not entirely their fault. The absence of effective systems by the Ghana Revenue Authority(GRA) to ensure that all potential taxpayers are brought into the tax net is majorly responsible,” he concluded.