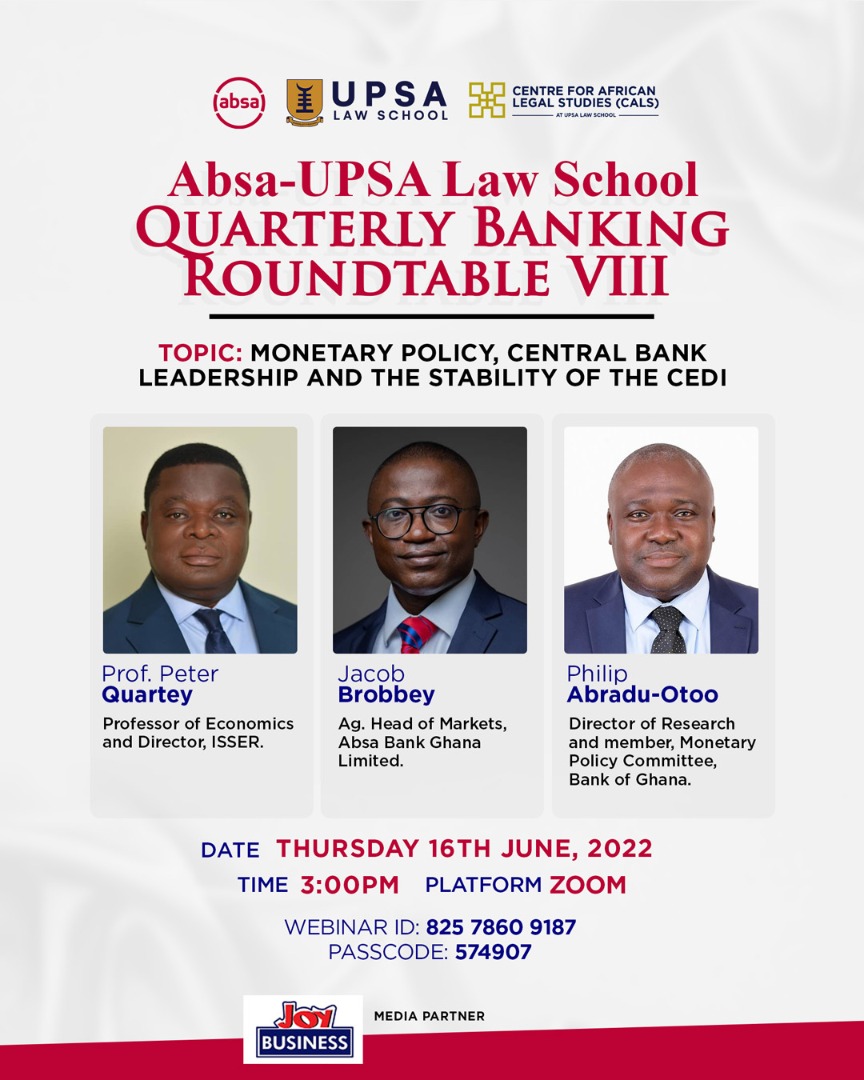

8th Absa-UPSA Law School Quarterly Banking Roundtable held

It featured the Director of Research and Member of the Monetary Policy Committee of the BOG, Philip Abradu-Otoo, a Professor of Economics and Director of ISSER, Prof Peter Quartey, and Ag. Head of Markets at Absa Bank Ghana, Jacob Brobbey.

The Centre for African Legal Studies at the UPSA Law School has held the 8th in the series of its Quarterly Banking Roundtable in collaboration with Absa Bank.

The event which was held virtually on June 16, 2022, was on the topic of; "MONETARY POLICY, CENTRAL BANK LEADERSHIP AND THE STABILITY OF THE CEDI” and had three astute Finance Policy brains as resource persons.

It featured the Director of Research and Member of the Monetary Policy Committee of the BOG, Philip Abradu-Otoo, a Professor of Economics and Director of ISSER, Prof Peter Quartey, and Ag. Head of Markets at Absa Bank Ghana, Jacob Brobbey.

MR ABRADU-OTOO

Contributing to the issue of Inflation Targetting, Mr. Abradu-Otoo noted that it is a monetary policy strategy that has been used from the 70s till now and that it is a rule-based regime having inflation and a real sector regime.

He added that it is effective because if you compare inflation performance under it, volatility in inflation has been minimal.

Further to the above, he said that even within the COVID mechanism, it's working because BOG deployed all tools to address growth under the IT Framework

He said that a law has been passed to give the Bank of Ghana operational independence.

On whether the BOG is delivering on its mandate, Mr. Abradu-Otoo asserted that the inflation surge started in the first half of 2021.

However, he did not overrule the impact of geopolitical tension in Eastern Europe and others that are out of our control and added that the inflationary challenges could be apportioned to 80% due to foreign factors and 20% to local shocks.

He said that the BOG is delivering on its mandate because if one adjusts all the conditions in our consumer baskets, our inflation is not doing badly.

Additionally, the Bank of Ghana, he noted has several measures to ensure macroeconomic stability and those policies are really working at the Commercial Banks level.

Moreover, he indicated that the cash reserve ratio did really help hence the stability in the exchange rate, and added that the price stability objective will continue.

PROF PETER QUARTEY

On his part, Prof Peter Quartey was of the view that there is a conflict between politicians and the Central Bank relative to the IT thus called for the independence of the Central Bank as is done in the UK.

He also noted that the rule-based monetary policy sustains the rule of independence and that even though the BOG has served us well, it cannot be only about monetary policy.

Moreover, the Prof mentioned that monetary policy is used to achieve the exchange rate we require but the IT mechanism is creating the impression that inflation is a demand pool.

Though he admitted that the IT regime has served the nation well, he said that inflation is not just a monetary issue because it has demand and supply sides thus the need to address the latter.

He admitted that some government policies have yielded results however we needed more food supply, more fertilizers, etc, and the need to go beyond just fertilizers and champion irrigation and prioritize the value chain.

Also, Prof Quartey indicated that Ghana has the right policies but the problem is getting the maximum from them.

The monetary policy he said has served us well however external factors are real and should be faced by structures built to deal with shock.

He also touched on policy consistency which he believes is an issue especially the policy reversal like the Benchmark value and as to whether the nation succeeded or not.

Three policy pathways were suggested by him as; the need for fiscal consolidation, property rate issues, and monetary policy thus bemoaned the situation where anyone can walk anywhere and change currency even without ID.

The Informal foreign exchange market, he said is driving volatility and called on the BOG to enforce its policy on that sector.

MR JACOB BROBBEY

Mr. Jacob Brobbey revealed that the banks have a lot of questions on their minds due to the high inflation rates because Central Banks across the globe are continually chasing inflation and wondering what happens to interest rates.

On whether IT is a sustainable path to choose, he said that the Central Bank ought to do something so the banks meet it halfway through.

He however admitted that the banks make money whether good or bad and that monetary policy made banks profitable.

Furthermore, Mr. Brobbey said that the Banking sector has successfully run through COVID challenges and the private sector is seeing growth however Business and Consumer confidence has dipped.

He added that risk is not just about banks because there is a high household interest rate which is making it difficult for them to access facilities or service existing ones.

Also, the business funding cost he said is going high and that the banks could have used the pre-COVID level cash reserve of 12% to write off loans or invest.

Mr. Brobbey asserted that we are not out of the woods yet due to the lack of control on the Russia-Ukraine War and the China zero Covid policy which is disrupting the global supply chain.

On local concerns among fiscals, he called for fiscal consolidation in order to quicken the pace and work on the variables we have control of in order to have access to the capital market to have funds and channel to other sectors.

To him, the currency will depreciate far more till the close of the year, and interest rates as well will stay at elevated levels.

He, therefore, called on the government to outperform its target on a fiscal consolidation plan which he said will involve Ghanaians paying the right taxes, a program by the government geared towards gaining access to the capital market.