5th UPSA Law School Africa Trade Roundtable held

The PAPSS was formally launched in January 2022. It is a centralized payment and settlement system for intra-African trade in goods and services. Africa currently has approximately 42 individual currencies.

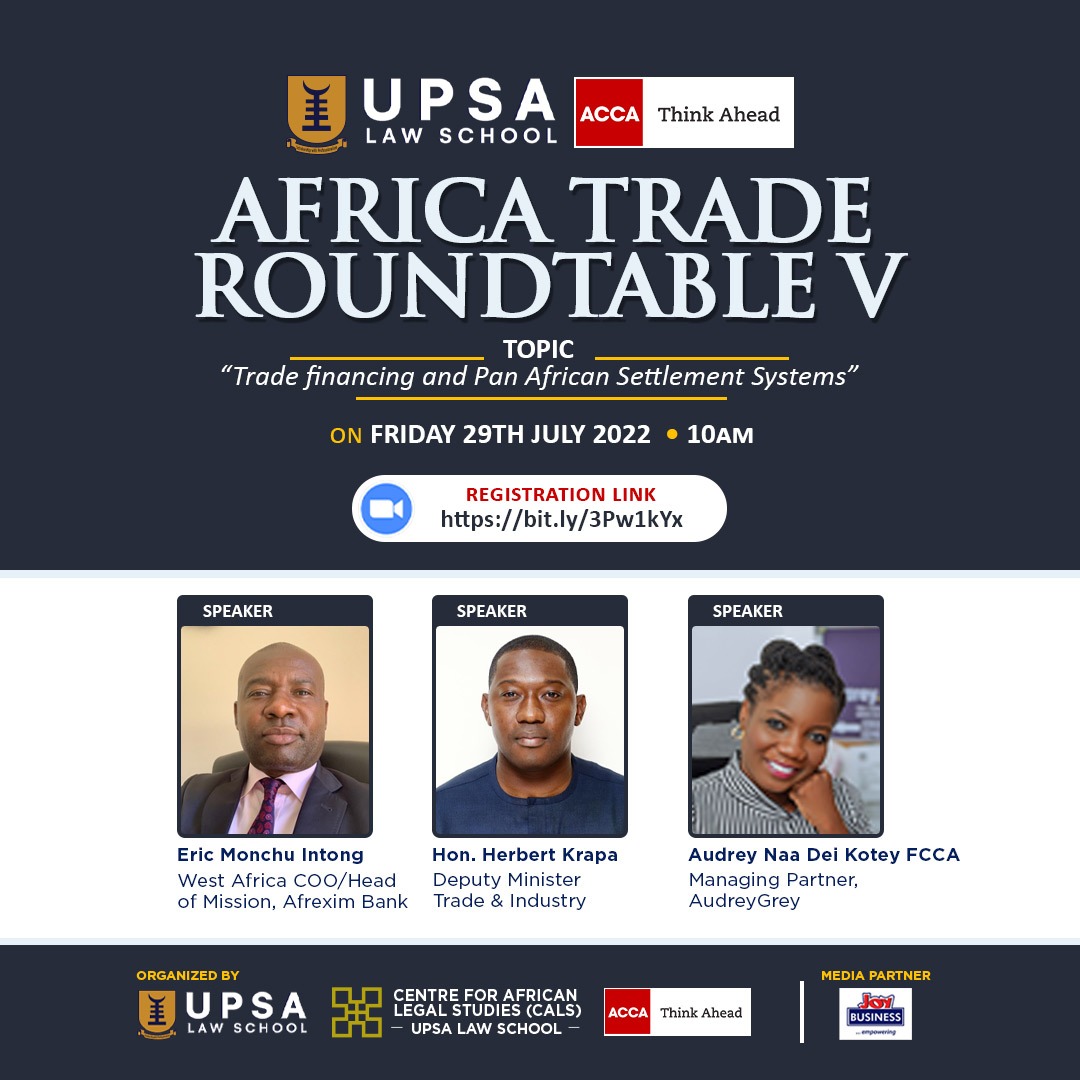

The 5th UPSA Law School Africa Trade Roundtable was held on Friday, July 29, 2022.

The virtual discussion, which is organized in partnership with the ACCA had renowned speakers with vast knowledge and expertise in Trade Financing on board.

To discuss the topic of ‘Trade financing and Pan African Settlement Systems’, the West Africa COO/Head of Mission, Afrexim Bank, Eric Monchu Intong, Managing Partner of AudreyGrey; Audrey Naa Dei Kotey and the Dean of the UPSA Law School; Prof Ernest Kofi Abotsi were connected virtually to do justice to the same.

At the end of the over two hours discussion, the speakers were ad idem on the fact that the PAPSS is a useful addition, a game changer, and a no-brainer relative to the African Trade financing regime.

Audrey Naa Dei Kotey

Audrey Naa Dei set the ball rolling when asked about the major payments and settlement challenges experienced in Africa. She was of the view that the PAPSS will enable Africans to trade through payment systems by controlled by us.

On the responsiveness of PAPSS to trade financing settlement, she indicated that it will be a useful addition by saving Africa a lot of time by eliminating the situation where purchasers will have to wait for 14 days for the payment to get to suppliers.

Also, Audrey mentioned that PAPSS will strengthen African currencies and give them a place on the negotiating table.

Further to this, the managing partner of AudreyGrey proffered possible ways of building trust in the PAPSS system. She mentioned the availability, and certainty of the system, among others.

Moreover, she called for Transparency in Africa’s financial sector. This entails identifying liquidity issues among countries and dealing with them before allowing them to become a problem for PAPSS.

Eric Monchu Intong

Head of Mission, Afrexim Bank commenced the discussion by outlining some challenges confronting Trade financing on the continent.

He mentioned the lack of an integrated system to permit Intra African Trade, the high cost of foreign systems like SWIFT, and the lack of trust in the continent’s fragmented systems.

ON PAPSS (PAN AFRICAN PAYMENT AND SETTLEMENT SYSTEMS)

Eric was optimistic that the system would allow users to pay and settle in local currencies and eliminate FX costs. Also, he said that the issue of convergence criteria is far-fetched and thus mentioned PAPSS as a solution.

Further to the above, he stated that PAPSS will allow African countries to do a net settlement thus reducing the volume and quantum of the dollars. By so doing we will be able to know which country is settling which one and which currency can be narrowed to a single currency.

Also, he revealed that PAPSS has instantaneous payments when one orders goods through local currencies.

PAPSS SO FAR

On the progress of the system, Eric mentioned that it was tested in the West African Monetary Zone when developed and that two languages; English and French were tested.

He added that the challenges of the system are being noted through testing and modifying same to eliminate those challenges observed.

Furthermore, he said that live transactions will be seen before the end of this year and that they have also tested transactions between Ghana and Nigeria, Liberia, and Sierra Leone.

Prof Ernest Abotsi

The Dean of the UPSA Law School mentioned on his part, the forex disparities, liquidity of central banks leading to pressures by foreign currencies, and Balance of payment deficits as some of the challenges affecting trade financing in Africa.

POLITICAL TENSION AND RISK ON PAPSS

Dean Abotsi noted that a new wind of change is blowing in Africa and that there is an emerging African sub-state thus was hopeful that the model of PAPSS can hardly be affected by politics.

He was however indifferent about the role played by the Central Banks in the PAPSS model.

BENEFITS OF PAPSS

He indicated that PAPSS can lead to growth in inter-bank trading- Instead of dealing with intermediary banks in Europe and elsewhere, African banks can indulge in high volumes of trade among themselves because transactions begin and end in local currencies.

Further to the above, the issue of trend analysis of African Trade was upheld by the Dean as another benefit of the system. This he said, will enable us to know which parts of Africa are winners and losers as the AFCFTA develops.

Despite the above, Prof Abotsi also shared one disadvantage of the AFCFTA which is; that when countries see themselves as losers, they will begin to see the AFCFTA as a disadvantage of a sort.

Additionally, he said that the AFCFTA is going nowhere without trade financing (Proper Financing) and that to achieve the full vision, the unbanked in Africa have to be banked.